Axa Home Insurance - login, review, contact, claims and quote

Axa has been around for three centuries but only began to operate under its present name in 1985. They are a massive insurer, with offices in almost 60 countries. In the UK alone, Axa Insurance employs ten thousand people to insure millions of customers’ homes, belongings, cars, health, and travel plans. Axa has also underwritten several brands of home and life insurance including Swiftcover, Homeguard and Marks & Spencer.

Reviews - Is Axa home insurance any good?

Axa has three policies, Homesmart, Homesure and Homesafe, available directly from its website. The three policies are very similar when it comes to the main areas of protection they offer. What changes across these three are the maximum claim limits and that the two higher tier plans will include some extra cover that is optional with the barebones Homesmart policy.

Homesure and Homesafe get the highest ratings from Defaqto, an impartial insurance rating body who retrieve and evaluate policy details. Both of these policies include accidental cover for buildings that will be helpful for any insurance claim where your home is damaged due to an accident, such as a car crashing through the living room window. This is normally something that you have to pay extra for, but not if you have insurance with Axa Direct under one of these two policies.

Homesafe goes one step further by also including accidental cover for contents and possessions which does add much-needed peace of mind, especially for families with children. With this policy, your belongings and home contents will be protected from things like spills or drops, though certain like technology or electronics may be excluded.

Is Axa good value for money?

| Level of Excess | Axa Home Insurance | Market Average |

|---|---|---|

| £100 | £227 | £309 |

| £200 | £190 | £292 |

| £300 | £149 | £245 |

Axa Home Insurance comes in at around £100 less per year than market averages. Exact savings greatly depend on the specifics of the home that is being insured, with things like a professionally installed burglar alarm making a noticeable difference to your premium.

There is no one-size fits all home insurance product and just like any other insurance provider, Axa has extra cover that can be tailored to your home, personal effects and lifestyle. Adding or removing such options will also change your premium.

One easy way to save money once you have picked Axa as your insurer is to choose yearly over monthly payments because the yearly rates are cheaper if you can afford to pay one lump sum.

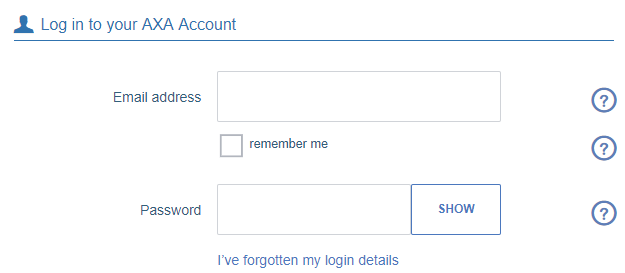

Axa Login - How to manage your account

Through their online account, Axa policyholders can check their cover details as well as the excess amounts that they may be liable for in case of a claim.

The online portal holds your policy documents as well as claim details. Axa promotes its online security, claiming their portal is the safest place for your insurance information. Additionally, you can update cover details as time goes on and circumstances change. This includes increasing and lowering excess amounts which will have an impact on your premiums.

Axa Policyholders can also find important renewal details through the online portal such as when a policy will be up for renewal. However, it is disappointing that this online portal does not give you the option to manage auto-renewal and cancellations.

Why automatic renewal is a bad idea for home insurance coverageHome insurance companies have restrictive cancellation policies and they will put people on auto-renewal by default which catches too many customers by surprise. This means that after a year and before you know it, your policy will have renewed and once past the 14 day cancellation period you will have to pay a fee if you have found a better deal elsewhere. The first thing you should do when signing up for a new provider is to cancel automatic renewals. With Axa, you must email them right after buying your policy, giving them your name and policy number so they can take you off automatic renewal.

Axa charges a one-time £30 cancellation fee on all its policies except for its flagship Homesafe policy which does not have an exit fee.

What kinds of home insurance policy does Axa offer?

Axa offers both building-only and contents-only insurance as well as a combination of both to protect your home. The maximum claim amounts are as follows:

- Building Insurance: £1 million

- Contents Insurance: £85,000

Another common feature across the range, is that as an Axa customer you get access to an around the clock home emergency helpline located in the UK.

The standard complement of optional insurance add-ons is also available. This includes things that any reasonable person assumes would be covered but often turn out to be outside the narrow definitions of a basic insurance policy. This is the breakdown of what Axa generally offers:

- Accidental damage cover both for property damage and valuables

- Personal property insurance that tops out at £25,000

- Bicycle insurance

- Legal insurance that includes advice and protection for personal liability which can go up to £50,000

Axa also offers an emergency repair service through a network of fast-response plumbers, electricians and other contractors. Policyholders will get up to £1,000 off total repair costs, including parts and labour.

Excess and deductible amounts can be adjusted by customers through their online portal account.

1. Building Only Protection

Building insurance focuses on insuring your house, its fixtures and its fittings. If the home is insured to the correct amount, it should cover the full rebuild cost if your home were to be destroyed by a natural disaster as long as the circumstances are covered in the small print.

Homeowners are required, by banks and mortgage issuers, to have at least building cover from a reputable insurance company. Be aware that the rebuild value of your home is not the same as its current sale price. For this reason, we urge homeowners to check the BCIS home value calculator, a free service from the Royal Institute of Chartered Surveyors.

For mortgaged homes, the bank actually owns the property while the mortgage is being paid off. So any damage to the structure writes off value not just for the buyer but also the money lender. Therefore, the bank wants to shift those risks back to the buyer who is left with no choice but to get insurance to reduce a financial responsibility that most people can’t effectively shoulder on their own, especially when already paying off a large loan. This is why it’s a good idea that homeowners are obligated to have at least buildings insurance.

It’s worth bearing in mind that a house is not just a dwelling but also a home. Insurance provides some peace of mind for a wide range of unfortunate situations, from vandalism to a storm or some other natural disaster like a flood. However, while this may help with things that happen generally outside the home, there is still a lot that can go wrong inside one.

2. Contents Only Protection

Let’s say there is a burglary, with building insurance making a claim means that repair expenses will be mostly covered. But what about stolen belongings? Unfortunately, the rule of thumb is that anything not bolted down will not be protected by building insurance.

To ensure your peace of mind extends to every valuable possession in your home, you will need to get contents insurance as well. If you do not own your home, you should only need to get contents protection because your landlord should be taking care of the buildings insurance. This is good news because it means a lower insurance premium for your home because as a tenant, you don’t need to protect the building itself, only the stuff inside that is yours.

Just like with building insurance, content cover has a narrow scope and many common situations are sadly excluded. Something like forgetting to set an alarm or some locks on a window when there is a robbery turns into a ‘get out of paying’ card for many insurance companies, which is why reading the policy documents carefully is so crucial before signing up.

3.Homeowners Insurance

Home Insurance often combines both buildings and contents protection under one roof. By bundling the two kinds of insurance together with the same provider you will be getting a lower total home insurance quote than if you were to get them separately. This only applies if you need both types of cover because you own your home.

4. Landlord insurance

While Building insurance is suited to homeowners and their primary property, it will not be sufficient for a home that is occupied by a tenant because of the cover’s exclusion clauses for residential insurance.

Axa offers tailor-made insurance to protect the investment landlords may have made in up to ten rental properties. They have designed this policy to keep properties protected with a minimum of fuss by linking premiums to inflation so that buildings and contents remain insured by the correct amount no matter when a catastrophe may strike.

Just like with their products for residential customers, Axa has several add-ons that can dramatically enhance protection for any landlord. For example, accidental damage cover doesn’t just deal with accidents occurring when work is being done on the property but also spills and stains caused by the tenant.

This policy can also scale up for landlords that may have several properties and who rely on people that maintain them by providing employer’s liability insurance to cover them in case of illness or injury.

Complaints about Axa

Axa informs their customers that when a complaint occurs, they respond to them as quickly as possible

They usually reply within a week of them receiving your complaint information. However, more complex issues often push back detailed responses by up to 45 days.

- If the complaint is in connection to legal issues due to a home property dispute then Axa asks that the legal representative gets looped in from the start.

- If the complaint is related to unacceptable claim handling then calling the phone number from the claim or policy documents themselves is the best thing to do. Alternatively, you can call these contact numbers to get more advice.

Going Further - the Financial Ombudsman

If Axa’s response is unsatisfactory, getting in touch with the Financial Ombudsman should be the next thing to do.

It is obligatory to contact to the financial ombudsman after receiving a reply from Axa but you must do so before six months pass by, otherwise this organisation will not be able to help.

Contact the Ombudsman:

By mail:

Financial Ombudsman Service

Exchange Tower

London

By phone: 0800 023 4567

By email: [email protected]