If you live in the UK, you are bound to have heard the name Barclays. You probably know the famous brand as a bank, but did you know it offers a multitude of insurance products too? From home insurance to gadget insurance, read on to find out more about Barclays insurance policies and whether they could be a good fit for you. You can also find information on how to make a Barclays insurance claim and see a step by step guide on how to login and manage your policy all online.

Barclays Insurance

From home and travel insurance to life and gadget cover, Barclays Insurance sells lots of different insurance products to its customers. Helping you protect and cover what matters most to you, Barclays Insurance falls under the personal banking arm of the worldwide banking sensation Barclays plc. Let’s take a look at this huge brand in more detail.

Barclays plc: what, when and who

Barclays plc is a British multinational investment banking and financial services company. Founded, and still based in London, it operates in four main areas:

- Personal banking (this is what Barclays Insurance falls under)

- Corporate banking

- Wealth Investment

- Investment management

A household name today in both the UK and across the word, Barclays can trace its roots all the way back to the late 17th century when founders John Freame and Thomas Gold starting trading in London. However, the name Barclays was not created until the mid 1700s. In 1736, John Freame’s son-in-law, James Barclay, became a partner of the bank, thus giving it the now famous name.

From London, the company expanded throughout the UK and also abroad. It now has over 4,500 branches in 55 different countries. 1,600 of these are in the UK.

In the UK, the banking group has been a leader in bringing new banking technology to British shores: it was the first bank to offer both credit and debit cards to UK customers. It has also branched out from bank accounts, now offering customers a plethora of financial services, including mortgages and insurance.

There are two British Barclays plc subsidiaries: Barclays Bank plc (which works in corporate banking); and Barclays Bank UK plc (which operates in retail/personal banking).

Timeline of Barclays: from its origins to today

- 1736 - The Barclays name becomes associated with the brand for the first time.

- 1896 - Several other banks operating in London unite and form Barclays and Company.

- 1990s - Barclays goes abroad under the name Barclays DCO (later named Barclays International)

- 1965 - The company expands to the US and opens the Barclays Bank of California.

- 1966 - It launches the first credit card in the UK.

- 1981 - The national and international arms of the company merge to form Barclays Bank plc, which later becomes just Barclays plc.

- 1987 - Barclays launches the UK’s first debit card: the connect card.

- 2013 - The company announces it’s first net loss in over two decades.

- 2015 - The company is the first UK highstreet bank to start accepting Bitcoin.

- 2016 - Barclays make a big deal with Apple, letting their customers use Apple Pay.

Finances and shares

Barclays plc is listed on both the London Stock Exchange (primarily) and the New York Stock Exchange (secondary).

Over the years it has seen some huge drops in its share prices. For example, in 2007 they dropped by nine percent following rumours of the company having been exposed to bad debt in the US. In 2009, its share prices fell even further - when the International Petroleum Investment Company sold 1.3 billion of its Barclays shares, Barclays share price fell by a whopping 54%!

It has also faced some big losses financially. In 2013, for the first time in two decades, Barclays plc announced that in 2012 it suffered a total net loss of £1.4 billion. This resulted in future plans to cut 3,700 jobs and reduce their annual costs by £1.7 billion.

Despite this big loss, Barclays continues to do well. In 2018 Barclays plc reported a profit of £3.5 billion (before tax), with it’s British arm, Barclays UK, making £2 billion (before tax).

Barclays Insurance policies

Barclays offers customers home, travel, life, and phone and gadget insurance. However, not all these policies are available to everyone. While anyone can purchase most of Barclays home insurance policies, the company no longer offers stand alone travel insurance. This means that to take out travel insurance with Barclays, you must have a Barclays bank account. The same is true for phone and gadget insurance.

Barclays is no longer offering car insurance. If you have a car insurance policy with Barclays, it will remain valid until the date stated in your policy documents.

Home insurance

Barclays offers quite a few different types of home insurance, including landlord and students insurance, contents and buildings insurance, and the typical combined home insurance policy, which comes in to two options:

- Barclays Home Insurance - this offers a very basic level of cover as standard, but allows you to add on lots of different extras to create a policy that is tailored to your needs. These extras include the likes of accidental damage, cover for sports equipment and home emergency cover.

- Barclays Premium Home Insurance - this policy offers very comprehensive cover as standard and pretty much includes all avenues of cover in the base policy, such as students cover and accidental damage.

Interested in Barclays home insurance policies and want to find out more? Head to our Barclays home insurance guide (coming soon) to see more details.

Travel insurance

Barclays offers two options when it comes to travel insurance. They are referred to as packs and are only available to customers who have a Barclays bank account. Both packs are also only available as annual multi-trip travel insurance, so are not designed for single trip holidays.

- Travel Pack - this is the more basic pack, but it still includes worldwide cover for the whole family with RAC breakdown cover when you are travelling in the UK and Europe.

- Travel Pack Plus - as the name suggests, this ‘pack’ comes with extras, but these extras aren’t related to the level of cover. The actual level of insurance is the same, but with the plus pack you also get access to airport lounges and discounts on airport parking and hotels.

Discover much more, including prices and customer reviews, in Selectra’s Barclays travel insurance guide.

Phone and gadget insurance

With Barclays Tech Pack, Barclays bank account holders can get cover for up to four mobile phones and an unlimited number of gadgets (laptop, mobile phone, tablet) that are each worth up to £1,500. This cover consists of worldwide protection for loss, theft, accidental damage and if the gadget stops working, so is great when travelling as gadgets aren’t usually covered in a travel insurance policy.

Make sure you read all the terms and conditions to check for any and all exclusions. For example, gadgets over five years old can’t be included on the policy. There is also a £75 excess charge on any claim, so there isn’t much point including your mobile if it is on the cheap side.

Who underwrites Barclays Insurance?

Barclays home insurance is underwritten by Gresham Insurance Company Limited, which is a member of the Aviva group. The premier policy (Barclays Premier Home Insurance) is underwritten by Hiscox Insurance Company Limited. Both travel insurance packs offered by Barclays are underwritten by Aviva.

How to make a Barclays Insurance claim

So, if you have a Barclays insurance policy, how do you make a claim? Is it an easy process? When looking online we found a few different phone numbers listed as what to ring if you need to make a claim, which can be a bit confusing!

Let’s start with home insurance. First things first, you can make a claim online. If your policy number starts with MHO, IQU or MPH, you can log in to your Barclays account (see below) and report your claim in the Make a claim section. If you policy does not start with one of these combinations you cannot claim through your account but can still claim online with the Barclays online claims form.

If you want to ring to make a home insurance claim, we advise you to look in your policy documents to find the correct phone number to ring. If you cannot find your documents, try the following number:

Barclays home insurance helpline

Someone will take your claim or direct you to someone who can

0800 0279 844

*Lines open 24/7, but are closed on December 25th

Now travel insurance. The only way to make a travel insurance claim is to ring Barclays. The correct number depends on the policy you have:

| Travel Insurance Policy | From the UK | From Abroad |

| Travel Pack | 0800 158 2685 | +44 1603 604 977 |

| Travel Pack Plus | 0800 404 6856 | +44 1603 604 964 |

| Premier Travel Plus Pack | 0800 158 2692 | +44 1603 604 979 |

If you have an existing ‘stand-alone’ travel insurance policy (policies Barclays used to offer that didn’t require you to have a Barclays bank account), call 0330 102 6416 from the UK and +44 208 763 3196 from abroad to make a claim.

If you have an existing Barclays car insurance policy, ring 0344 871 2372 to make a claim.

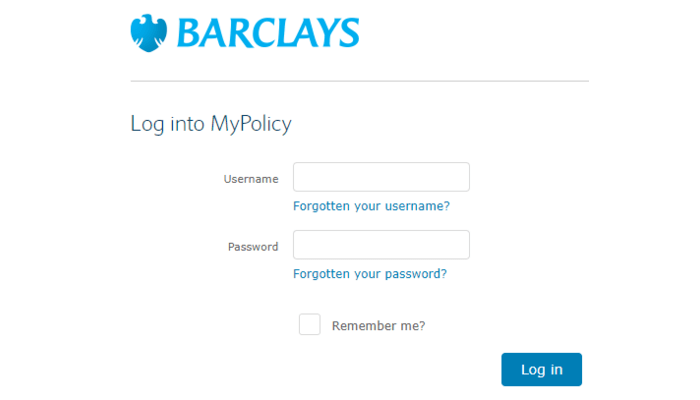

Barclays Insurance login

The Barclays online system for insurance customers is called MyPolicy, but it is only available to customers with a home insurance policy that starts with:

- MHO

- IQU

- MPH

For those lucky enough to have access to this system, it makes managing your policy a lot easier, letting you view and download your policy documents, update and change personal details, add items onto your policy and even make a claim all online.

If you are having some problems logging in, follow these Barclays Insurance login steps.

- Access the login page by typing ‘Barclays MyPolicy login’ into your search engine. The first result should read Barclays MyPolicy. Click this and you will be on the login page.

- In the box next to username, type in the username you set up when you registered for your account.

- In the box next to password, type in your password.

- Press the blue Log in box and that’s it: you will now be in your account.

If you already have Barclays online banking, you can also access the MyPolicy system from your online banking account homepage.

Want to log in to your MyPolicy account now? Just click the button below.

If you need to make any changes to your travel insurance pack, you need to call Barclays on 0800 404 6856 from the UK or +44 1603 604 964 from abroad.

Barclays Insurance number: complaints & queries

Whether you want to complain to Barclays or just have a general question, we have the Barclays Insurance number or alternative method of contact you need.

Queries

If you have an existing policy with Barclays and need to clarify a few issues you aren’t sure about, give the relevant number listed below a ring:

- Home insurance: 0800 015 0246 (Mon-Fri: 8am-10pm; Sat: 8am-6pm; 10am-4pm)

- Barclays travel pack: +44 1603 604 977 (24/7)

- Barclays travel pack plus: +44 1603 604 964

- Barclays tech pack: 0800 158 3199 (Mon-Sun: 8am-10pm)

- Existing car insurance policy: 0344 71 2373 (Mon-Fri: 8am-9pm; Sat: 9am-5pm; Sun: 10am-4pm

If you do not want to call, or do not have an existing policy with Barclays, there are a number of other ways you can get in touch.

- Send a message using the Barclays online chat.

- Fill out and submit the Barclays Contact Us form.

Do not include any personal or sensitive information in your online chat or Contact Us form message. You can find both these methods of contact on the Barclays website, underneath the Contact Us tab.

Barclays are also active on social media so you can always just send them a message on Facebook or Twitter. We used the Facebook messenger method to see how effective it was as a means of contact. Our messages we replied to swiftly (within 10/15 minutes), the responses answered our questions adequately and the customer service agent was helpful and friendly.

Complaints

You can issue a complaint with Barclays either online or over the phone. If you would prefer to do so online, you can do so via Barclays online web chat or by sending a secure message.

To send a complaint via the web chat, log in to your account, select the Contact Us tab and then the Your Complaint tab. You will then be able to talk to a customer service agent in real time.

To issue a complaint via a secure message, you need to log in to your account and fill out the Barcalys complaint form.

If you are a bit more old fashioned and would prefer to call Barclays in order to make your complaint, ring the number listed below.

Barclays complaints number

A Barclays customer service agent will register your complaint

0800 282 390

*Lines operate 24/7, but are closed on the 25th December

Barclays aim to solve all complaints within 15 days. Failing this, they strive to get to the base of the problem and find a solution within eight weeks. The time it takes to resolve your issue will depend on the individual circumstances of your complaint.

Barclays Insurance reviews

It’s very hard to find reviews of Barclays Insurance as a whole online. Typically reviews are either focused on a particular insurance policy, or on the Barclays company as a whole, meaning including their banking services.

On Trustpilot, for example, Barclays has a rating of 1.6/5, with 83% of 1634 reviews rating the company as bad. While this is refers to Barclays UK as a whole, we can see that most of the bad comments focus on poor customer service, something that is also related to the insurance products it provides.

Terrible customer service, passed between people and put on hold multiple endless times. Online chat person was rude. William

While this is not conclusive or extensive evidence that insurance customers receive bad customer service, it is useful to know that this is something more than a dozen customers have complained about.

Complaints data

Another way to rate customer satisfaction is by looking at the number of complaints Barclays receives. From the company’s own data, we can see that they managed to resolve 167,639 insurance related complaints from July to December 2018. This is more than a lot of other providers for the same time period, but does also suggest that Barclays also receives a lot more complaints in the first place.

Is Barclays efficient at dealing with these complaints? In this six month span it only managed to close 10% of these complaints in three days, which is one of the lowest percentages we have seen (Admiral, for example, solved 58% of complaints received over six months in three days, and AXA 40.30%).

However, making up for its original poor performance, it does then solve 84% within eight weeks, which is one of the highest figures we have seen. Plus, Barclays Insurance actually up held(meaning saw as valid) 89% of complaints, which is again one of the highest figures we have seen (Admiral only upheld 47% and AXA 68%). This could explain why Barclays is slower at solving complaints in the initial three days.

The main complaint Barclays received during this period was ‘advising, selling and arranging’, suggesting customers have experienced issues with the process of purchasing policies and the advice given by customer service.

For a more detailed review of Barclays insurance policies, head to either our Barclays home insurance or Barclays travel insurance guides. These contain more specific customer reviews, reviews from industry professionals and more in depth policy information, as well as price comparisons.

Data and information correct as of September 2019.

All material on this page and the selectra.co.uk website is for information purposes only and does not constitute any form of financial advice. Selectra.co.uk is not responsible for any consequences that might arise from your use of the information provided.

Barclays Insurance

Barclays Travel Insurance: Want the Best Pack?