About Aviva

Aviva is a British multinational insurance company and pensions provider. It is the UK’s largest general insurer (car insurance, home insurance, travel insurance, etc.) and is the sixth largest insurance firm in the world. These are some pretty big credentials! From its history, shares and insurance policies, to its online account management and customer reviews, let’s find out more about this huge international insurer.

History: the story of Aviva

The Aviva we know today is the child of a few big mergers in the insurance world. It can trace its roots all the way back to the late 17th century when the world’s oldest existing fire insurance office, Hand-in-Hand, was founded after the Great Fire of London. Over the years, a number of other insurance companies emerged, such as Norwich Union in 1797, Commercial Union in 1861 and General Accident in 1885. For years these companies worked separately in the insurance world, creating new insurance policies and advances in the industry, but they would all eventually come together in one way or another to form Aviva.

In 1998 Commercial Union and General Accident merged to form the famous British insurance firm CGU plc. Then in 2000, CGU plc joined with another big British firm, Norwich Union, to form CGNU. In July 2002, CGNU rebranded and became Aviva. However, the company continued to use the trusted and well-known name Norwich Union in the UK. This all changed in June 2009 when Norwich Union also became known as Aviva.

Since then, Aviva has taken over many companies and also sold parts of its own business. For example, after acquiring breakdown recovery company RAC in 2005, it sold it to The Carlyle Group in 2011 for £1 billion. Perhaps one of its biggest acquisitions, in 2015 Aviva took over life insurance company Friends Life for £5.6 billion.

If you are history mad and want to take a really detailed look at the insurer's past, check out Aviva’s own interactive timeline.

Present day

Today Aviva offers many different types of insurance and has 33 million customers across 16 different countries. It paid out a total of £33 billion in claims to its customers in 2018 and prides itself on being an ethical company; here are its four main values:

- Kill complexity: it strives to kill the complexity and confusing nature of insurance policies so it can provide its customers with the best service.

- Care more: getting the best outcome for its customers is its number 1 priority.

- Never rest: Aviva aims to keep developing innovative ideas into working products and services for its customers.

- Create legacy: when it comes to investing, it aims to make the best decisions for the future of its customers.

What companies does Aviva own?

In the UK, Aviva has three main subsidiaries: Aviva Life, which provides services in a few different areas including pensions, investments and life insurance; Aviva Insurance, which provides general insurance; and Aviva Investors, which is a fund management company.

It also has subsidiaries in the following countries:

- Aviva Canada in Canada

- Aviva-Cofco in China

- Aviva France in France

- Aviva India in India

- Aviva Direct and Aviva Health in Ireland

- Aviva Italia Holding S.p.A. in Italy

- Aviva Polska in Poland

- AvivaSA Emeklilik in Turkey

Who is the CEO of Aviva insurance?

In March 2019, Maurice Tulloch was appointed Aviva’s new CEO. He is currently leading a review of the business and is expected to shake a few things up as he puts his mark on the company. Expect some changes to Aviva in the near future.

Aviva news

Seeing as Aviva has been around for such a long time, there is no shortage of news stories about the company. Most recently, the international insurer hit the headlines for changes to management and announcements that it will cut 1,800 jobs globally over the next three years. Following the appointment of new CEO Maurice Tulloch, there has been speculation that the company might split its UK business into two parts, but this is yet to be confirmed.

You can check the online Aviva Newsroom for all the latest Aviva news and updates.

Aviva shares: share price and management

As of March 2019, Aviva has 551,493 individual shareholders. These individuals make up around 98% of the company’s total shareholders. The remaining 2% is made up of banks and companies, pension fund managers and insurance companies, and other corporate bodies. All Aviva shareholders get discounts on certain Aviva products and services.

Current shareholders: manage your shares

If you own Aviva shares, you can manage them all online. Aviva has worked hard to develop its online platform - MyAviva shareholder services - where shareholders can view useful information related to their shares, such as shareholder meeting dates, and also check their Aviva policies. Here you can also find a link to the Investor Centre.

The Investor Centre is a secure online service run by Computershare where you can manage the nitty-gritty part of your shares. You can view your share balance, see the current market value of your shares, update your dividend mandate bank instructions, and view previous transactions and payments.

Aviva Share Account

Shareholders can choose to hold their shares in the Aviva Share Account, which means your shares will be held in the name of a Computershare Nominee. If you want to hold your shares here, you can apply through Computershare to transfer your shares over. There is no transfer fee, but you will be charged if you want to withdraw your shares from the share account. The withdrawal charge is currently £17.50 (June 2019).

Do you want to buy Aviva shares?

Anyone can buy Aviva shares and become an ordinary shareholder in the company. If you want to buy shares you can do so through any bank, building society or stockbroker that offers a share dealing facility to buy or sell Aviva shares, but bear in mind that each will charge their own commission rates.

The price of Aviva shares constantly fluctuates (just like the share price of all companies). If you are interested in buying Aviva shares, make sure you keep an eye on recent developments in the market and the company, as well as anything that could affect the share price before you invest. It might be a good idea to seek advice from a financial advisor before investing your hard earned cash in this way.

Aviva Insurance

Aviva offers life insurance and general insurance. General insurance refers to all insurance that is not life insurance, including car insurance (coming soon), home insurance, travel insurance etc. Here at Selectra, we are mainly interested in these three types of insurance.

Home insurance

Aviva has recently introduced AvivaPlus for home insurance. This breaks up its principal home insurance policy into three different levels: Basic, Regular and Premium. These levels include different aspects of cover and have different maximum claim limits. For example, the Basic level does not include cover for accidents at home, whereas Premium cover does.

All levels include cover for stolen or lost keys, new-for-old contents insurance - meaning Aviva will replace or repair damaged items - and a guarantee to match or better your policy price when you renew. Find out more, including how Aviva’s prices compare to other home insurance providers, in Selectra’s guide to Aviva Home Insurance.

As well as the standard combined buildings and contents insurance, Aviva also offers standalone buildings insurance, contents insurance, landlords insurance, and tenants insurance.

Confused about what home insurance you need? Read our complete guide to all the different types of home insurance to find out which is right for you.

Car insurance

AvivaPlus is also available for car insurance. Like AvivaPlus home insurance, this also has three different levels of cover, as well as extra protection that you can choose to add on. No matter the level you decide to take out, you will be covered for transport after an accident and will still be covered if you are involved in an accident with an uninsured driver.

All levels cover main and additional drivers for social, domestic and pleasure commuting purposes. Only the main driver and a named partner driver will be covered to use the vehicle for personal business use. Aviva has a specific car insurance policy for business vehicles, as well as multi-car policies, van insurance and motorbike insurance. Find out more in Selectra's guide to Aviva Car Insurance (coming soon).

Travel insurance

Avia offers one travel insurance policy for single trips and one annual policy for multiple holidays. The Single Trip Insurance covers you for up to 120 consecutive days abroad, as well as a holiday taken within the UK if you are away for at least two consecutive nights (not days).

The Annual Multi-Trip policy covers you for multiple individual holidays throughout the year. For each holiday, it covers you for up to 31 consecutive days, but you can increase this to 90 days if you wish. It will also cover you for holidays in the UK when you stay away from home for at least two consecutive nights.

Both the Single Trip and the Multi-Trip policies include emergency medical expenses, cover if you need to cancel your trip, and cover for your travel documents and cash/bank notes you take with you. Head to our Aviva Travel Insurance guide to see customer reviews, how to make a claim, and if Aviva travel insurance is good value for money.

My aviva: What is MyAviva account?

Everyone who has an insurance policy with Aviva can have a MyAviva account. This account gives you access to Aviva’s digital hub where you can manage everything to do with your policy all in one place, including viewing your policy documents and making changes to your policy. You can even make a claim through your account, which saves you having to call Aviva’s customer service team.

Aviva login

Logging in to your MyAviva account is super easy. Let’s go through the process step by step:

- Head to the login page: if you type MyAviva into your search engine, your first result should be Welcome to MyAviva - Login or Register. Click this and you will be taken straight to the login page.

- Type in your username: in the box under Username, enter the username associated with your MyAviva account. This might simply be your email address so try to remember what you set up when you first registered your account.

- Enter your password: in the box under Password, type in the password you use for the account.

- Login: underneath the box where you enter your password, there is a yellow box with Log in written inside. Click this box and you will be taken to your personal MyAviva account.

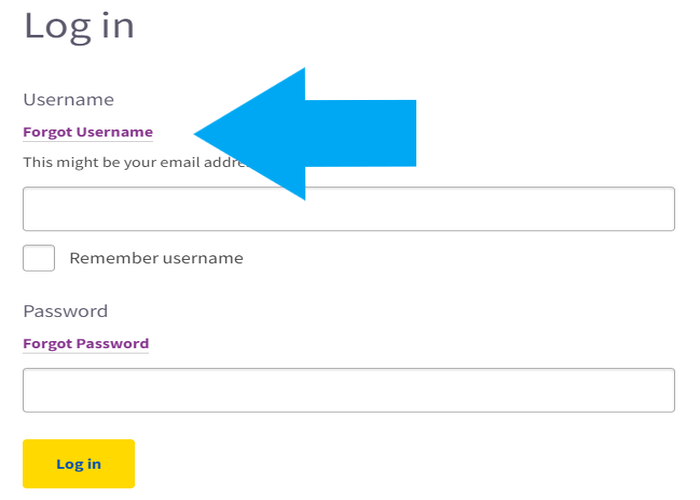

I’ve forgotten my MyAviva username

If you’ve forgotten your username, it’s really easy to find out what it is. Above the box where you are asked to enter your username on the login page, Forgot Username is written in blue. Click this and you will be taken to a new page called What is my username?.

You then have two options to recover your username. You can either enter your email address and Aviva will find your username and let you know what it is, or you can recover it using your personal details.

If you want to recover your username using the second method, click the phrase Find your username with your personal details instead on the What is my username? page. This will take you to a new page where you need to enter your name, postcode and date of birth. Follow all the instructions and you will recover your username.

On the original MyAviva login page there is an option to Remember username. If you check this box, your username will be saved on the page so you will not need to worry about remembering it everytime you want to log in.

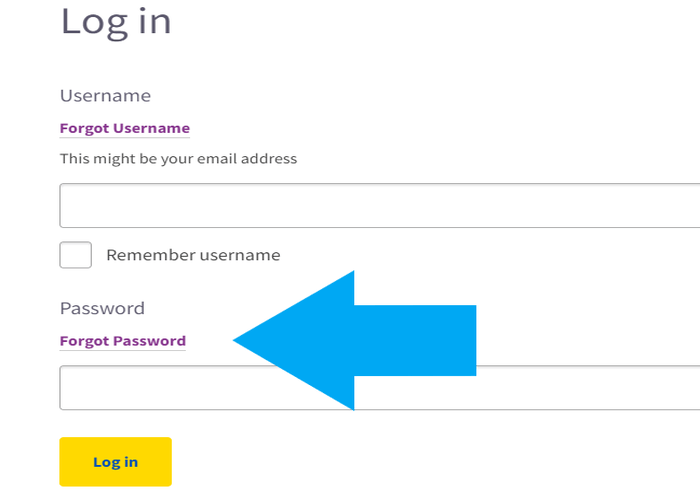

I’ve forgotten my password

You can reset your password by clicking the Forgot Password link above the box where you enter your password on the MyAviva login page. This link will take you to a new page where you can set up a new password by entering your username and date of birth.

Don’t have a MyAviva account? Here’s how to register

If you have never viewed your policies online before, you won’t have a MyAviva account. To set one up, head to the main MyAviva login page. You can set up an account by clicking the Register button that’s at the bottom of the page.

You will need to enter your activation code (Aviva should give you this when you take out your policy). If you do not have a code don’t worry, simply press the button that says Register without code.

Whichever way you choose to proceed (with or without an activation code), after you have followed all the instructions you will have an activated MyAviva account. Now you will be able to manage your policy all online.

Aviva app

Aviva also has a mobile app where you can manage your policies. The MyAviva app is essentially the same as your MyAviva account but it’s optimised to look and work better on mobiles and tablets. It is available for Apple devices via the App Store and Android devices via Google Play.

Aviva’s app has quite mixed reviews online with a 4.5 /5 rating on the App Store and a 3.3 /5 rating on Google Play. Some users find the app really useful and easy to use.

Easy to use and navigate. Self service to help you find your documents and even modify your policy - took two minutes to change my vehicle. Fantastic app! Pete

However, a number of users complain that the app crashes frequently. This problem seems to have coincided with a recent update to the app so Aviva might resolve it soon.

Used to be really helpful, but for some weeks now, it hasn't worked at all. Just crashes on the loading screen repeatedly. Robin

How do I contact Aviva?

There are different ways to contact Aviva depending on why you want to get in touch. First things first, if you are an Aviva customer you can start with your MyAviva account or the MyAviva mobile app. You might be able to find the answers you are looking for by having a little explore on either of these platforms.

If you can’t find the answer or are not an Aviva customer, you will probably need to give Aviva a call or send the customer service team an email. Head to our Aviva contact page to find the exact contact details you need for your query or issue.

Aviva activities: Community Fund and Red Cross

On top of offering various insurance policies, Aviva also works directly with people and organisations to support communities in the UK and around the world. The Aviva Community Fund is a huge project that supports local causes and the insurer has also partnered with British Red Cross to help communities in need.

Aviva Community Fund

Aviva’s Community Fund is a competition where communities can apply to receive funding for local projects that benefit the community. The fund finances 500 projects every year across four different funding levels: £1,000, £5,000, £10,000 and £25,000.

If you are interested in entering a local project, register on the Aviva Community Fund website to receive updates and alerts on when the application period opens.

Britsh Red Cross

Aviva has had a strategic partnership with Britsh Red Cross (BRC) since October 2015. With projects such as Missing Maps, they are working together to build more resilient global communities and to make sure aid gets to places that are ‘not on the map’ when natural disasters hit.

At home in the UK, Aviva gives all of its call center staff Red Cross psychosocial training so they can spot signs of stress when a customer contacts them and provide help and support that reduces this stress. It also sponsors the BRC community reserve volunteer project, which encourages locals to volunteer and help out in their local communities.

Aviva jobs

Aviva employs 31,700 people worldwide, including 15,000 in the UK. If you are interested in working at Aviva, head to its careers page to see all current vacancies. Aviva also advertises new job opportunities on LinkedIn so don’t forget to connect with them on the social network site.

Aviva careers

Like most big companies, there are plenty of different career options at Aviva in a range of professions, including human resources (HR), marketing, accountancy and customer services. The insurer welcomes people of varying levels of experience: from people who have just left school and are looking for their first job, to people who are experts in their respective fields.

Aviva graduate scheme

The official name for the Aviva graduate scheme is the Global Graduate Leadership Programme. While it is aimed at recent graduates (students can apply during their last year of university), Aviva still welcomes applications from people who graduated a few years ago.

The scheme is a great opportunity to develop professional skills in different areas and to experience working for a multinational company. It lasts two years: In the first year graduates are placed in a UK project and in the second year they get to work overseas at one of the Aviva international offices.

Aviva also has an accredited apprenticeship scheme for those who do not have a university degree.

MyAviva extras

Working for a big international company often comes with some perks and Aviva is no exception. The company offers all employees comprehensive benefits such as healthcare, discounts on Aviva insurance policies and in-house financial advice. It was also the first company in the UK to offer equal parental leave.

All Aviva employees have access to MyAviva extras, an employee benefits programme through which they can get discounts on various products.

Reviews of Aviva

When it comes to reviews, it’s much more useful to look at Aviva in sections rather than as a whole. After all, if you’re interested in Aviva home insurance, you don’t want to know what customers think of Aviva car insurance right? For a detailed review of a particular type of Aviva insurance, head to our separate Aviva Home Insurance, Aviva Car Insurance (coming soon) and Aviva Travel Insurance guides.

Aviva customer service

What we can look at as a whole is Aviva customer service. Across all insurance areas, what do real Aviva customers think of their customer service experience with the company?

To start, Aviva does not fare well on review site TrustPilot: 81% of reviews rate the insurer as ‘bad’, meaning the company has a very poor overall score of 1.5 /10 (you can’t do much worse than that!). Customers on this platform often complain about poor and slow customer service.

If you are looking to buy any kind of insurance then just avoid them, they will do anything to waste your time and money. Zero help and horrible customer service. Dissatisfied Aviva customer

However, on another review site called Feefo, Aviva has a 4.5/5 rating with customers claiming the customer service is very efficient, friendly and helpful.

Excellent customer service, girls were extremely helpful and I had renewed a lapsed policy in minutes over the phone. Thank you. Mary

There is quite a stark difference in the impression you get about Aviva from these two separate review sites. We had a little look into why this could be and think we have found the answer. Trustpilot only has a total of 982 Aviva customer reviews, whereas Feefo has 3,315 (June 2019). It therefore seems that customers do not bother to review Aviva very frequently on TrustPilot, and when they do it’s mainly to give a negative review. More customers leave reviews on Feefo so there is a greater mix of positive and negative reviews, resulting in the overall score not being so heavily weighted toward the bad ones.

Does Aviva receive a lot of complaints?

While Aviva seems to have a good star rating on Feefo, the insurer receives one of the highest number of complaints out of the top providers in the UK. From July to December 2018, it received 7.3 complaints for every 1,000 policies in force. LV, Covea and AXA all received less than 2 per 1,000 in the same time frame, so Aviva receives significantly more complaints than these other top UK insurance companies (not a good sign for Aviva!).

Over these 6 months, Aviva closed 176,062 complaints, which is more than other providers but this could simply be because it receives so many more complaints! It resolved 36% of these within 3 days and 60% within 8 weeks. Based on these percentages, Aviva’s effectiveness at solving complaints is pretty average: it is not the slowest but is also not significantly faster than others.

The principal reason forcustomer complaints made to Aviva in this timeframe was problems with general admin and poor customer service, so perhaps there is more truth to the TrustPilot reviews than we initially thought.

Selectra’s verdict

Being one of the biggest insurers on the UK market has its positives and negatives. Aviva’s experience and expertise in the insurance world means it knows what it is doing. To have endured for so long and remain the leading insurer in the UK with millions of loyal customers means it must be doing something right. Its policies are very comprehensive and easy to understand, which is no small feat for insurance providers. Plus the introduction of new levels of cover with AvivaPlus gives customers more options.

However, sometimes a name can carry a lot of weight and customers have a tendency to stick to what it is familiar. This means that Aviva can push its prices up with the safe knowledge that it will retain customers and continue to gain new ones. Aviva is not the cheapest insurance supplier and customers can likely get a bigger bang for their buck from a smaller, less known provider. Moreover, it receives a lot more customer complaints than the other providers we have reviewed.

|

|

|

|---|---|

| Insurance policies are comprehensive and new coverage levels give more options. | Not the cheapest - smaller providers can work out a lot cheaper. |

| Easy to use online account system and a handy app. | Receives one of the highest number of complaints compared to other UK providers. |

Data and information correct as of July 2019.

All material on this page and the selectra.co.uk website is for information purposes only and does not constitute any form of financial advice. Selectra.co.uk is not responsible for any consequences that might arise from your use of the information provided.

Other providers are available and the best deal for you will depend on your individual circumstances. Please do your own research and seek professional advice if necessary (moneyadviceservice.org.uk offers free, independent advice on all financial issues).

Aviva

Aviva Contact: Numbers, Emails & More

Aviva home insurance - contact, review, policy, login

Aviva Travel Insurance UK- Review, Policy, Contact