LV Insurance

The Liverpool Victoria Insurance Company Limited, which is commonly shortened to LV Insurance, LV or LV=, is one of the UK’s largest insurance companies. As well as offering general insurance (car insurance, travel insurance, home insurance etc.), it also provides life insurance, pension and retirement services, professional financial advice, and handles investments. In this guide we are going to focus on LV as an insurer, paying particular attention to the general insurance policies it offers. Let’s get started.

History of LV Insurance UK

LV Insurance was founded in Liverpool way back in 1843 by a 36-year-old customs officer named William Fenton. Back then, LV was known as The Liverpool Independent Legal Victoria Burial Society and was associated with so-called penny policies. These policies were designed to help members of the working class leave a little something behind to cover the cost of their funerals. Once a week, agents would go door-to-door to collect a penny from policyholders - it was life insurance at its simplest!

If you have an unclaimed penny-policy from before 1998, you can still claim it. If all the premium payments are up to date, LV will honour the sum assured amount plus any bonuses. Do you think you have an unclaimed policy? Trace your policy here.

Over the years, LV Insurance expanded by acquiring many of the other insurance and burial societies that were in operation, and grew into one of the UK’s largest friendly societies. By 1930 it had built and opened its new headquarters in London and was taking care of 13 million life insurance policies for its customers.

In 1996 the company acquired insurance broker the Frizzell Group, rebranded to become the Liverpool Victoria Insurance Company and launched into a new market: general insurance. Since then it has secured some impressive deals with top insurance companies to progress even further in the UK market. In 2006 LV acquired ABC insurance in a £1 billion deal and in 2007 it won a contract to become the insurance provider for all Asda Money customers.

In 2017 it also started a joint venture with German multinational insurance provider Allianz to become the third biggest personal insurer in the UK.

Timeline

- 1843 - Willam Fenton founds The Liverpool Independent Legal Victoria Burial Society.

- 1885 - The company starts to expand and acquires the Liverpool Crown & Anchor Friendly Society.

- 1930 - The insurer moves its head office from Liverpool to London where staff now look after 13 million policies for customers.

- 1933 - LV acquires the Most Friendly Burial Collecting Society.

- 1957 - Ardwick Union Burial Society is acquired by LV.

- 1970 - The World Snooker Championships is staged at LV’s London head office.

- 1996 - LV acquires the insurance broker Frizzell Group and move its head office to the Frizzell Campus in Bournemouth. LV starts to sell general insurance.

- 2001 - The company acquires the Royal National Pension Fund for Nurses (RNPFN).

- 2006 - LV acquires ABC insurance.

- 2007 - LV bought breakdown service Britannia Rescue and won a contract to be the insurance provider for Asda Money customers.

- 2017 - Insurance firm Allianz agree a joint venture with LV to become third largest personal insurer in the UK.

Present day

As of 2019, LV Insurance has been going strong for over 175 years. It has 5 million customers throughout the UK and offers a wide array of insurance policies in multiple insurance sectors, such as car insurance, home insurance, travel insurance, pet insurance and life insurance.

Its headquarters are now based in Bournemouth, and it also has offices in Birmingham, Brentwood, Bristol, Cardiff, Croydon, Exeter, Hitchin, Huddersfield, Ipswich, Leeds, London, Maidstone, Manchester and Poole.

Finances: who owns LV Insurance?

Unlike a lot of insurance companies, LV Insurance has no shareholders. It is a mutual society which means that it’s collectively owned by all of its members. A member is classified as anyone who takes out a particular type of product with the company; taking out an insurance policy with LV doesn’t necessarily qualify you as a member.

The qualifying member policies are typically related to the life insurance side of LV Insurance and membership lasts until the policy comes to an end (bear in mind that some of these are ‘legacy policies’, meaning they are old policies that you can no longer take out). If you do not take out one of these policies, you will simply be a LV customer and will not be an owner of the company. In 2018, LV Insurance had 1.2 million members.

LV Members are entitled to a number of benefits including: discounts on insurance; financial assistance; and access to the LV's confidential health and wellbeing helpline. Find the helpline number in our LV contact guide.

Richard Rowney has been the CEO of LV since 2016 and Alan Cook is the company’s current Chairman. Since 2017, Steve Treloar has been the Chief Executive of the insurer's booming General Insurance department. In 2018, LV Insurance returned a profit of £20 million (before tax).

Community initiatives

Seeing as LV Insurance started as a small friendly society to help the poor, it only seems fitting that the insurer is still heavily involved in supporting communities throughout the UK. It does this through three main community initiatives: fundraising, investment and partnerships.

- Community fundraising:

LV Insurance supports many national fundraising events, such as the Macmillan Coffee Morning, Comic Relief and Children in Need. It is even one of the official call centres for Children in Need’s annual telethon event.

Additionally, it encourages it workers to raise as much as they can for charities and for every pound they raise, LV promises to match it. It also has a Pennies for Charity scheme that sees its workers donate the odd pence from their net pay every month to charity.

- Community investment:

Every LV Insurance office has a Regional Community Committee that decides how the company will work to support the community in the given area.

- Community Partnership:

The company currently works with two charities: LV=KidZone, which strives to keep children safe on the beaches of Bournemouth during the summer; and Call in Time, which is Age UK’s telephone befriending service. As part of this latter partnership, LV employees help to combat loneliness by making weekly phone calls to elderly, isolated and vulnerable people for a regular and friendly chat.

LV Insurance policies: car, home & travel

As mentioned previously, LV Insurance offers a wide range of insurance policies. Here we are going to focus on its general insurance policies; specifically the home insurance, car insurance (coming soon) and travel insurance policies it offers.

LV Home Insurance

LV offers two different levels of home insurance: Its aptly named Home policy offers basic yet comprehensive coverage, while its Home Plus policy provides greater coverage, including unlimited buildings insurance cover and full accidental damage cover. Customers also have the option to add on a number of extras to both levels in order to tailor the policies to their needs. For more details on LV home insurance, check out our LV Home Insurance guide.

As well as standard home insurance, LV also provides landlord insurance and tenants insurance. Confused about all the different types of home insurance that are out there? Read our guide to home insurance for the complete low-down.

LV Car Insurance

The comprehensive car insurance provided by LV Insurance includes quite extensive coverage in the base policy. With this policy customers are covered for accidental damage, remain covered if they are involved in an accident with an uninsured driver and are covered if they fill up their car with the wrong fuel. It also includes cover for vandalism, a promise to replace child car seats if they get damaged, and provide new locks and keys if needed. Even better, the cover still applies when using the car in other European countries.

In addition to personal car insurance, LV also offers multicar, electric car, van and classic car insurance. Find out more in the Selectra guide to LV Car Insurance (coming soon).

LV Travel insurance

There are two types of travel insurance available from LV Insurance:

- Single trip insurance: this covers the policyholder for one trip during the year. If you are under 65, it will cover you for up to 366 consecutive days abroad (that’s a pretty long holiday and great for gap years, backpacking and working holiday visas!). If you are between 65 and 79 it will cover you for 65 consecutive days. Those 80 and over are only covered for 30 consecutive days.

- Annual multi-trip insurance: this policy covers the policyholder for multiple holidays during the year. Each holiday is limited to 90 consecutive days of coverage.

Both policies have two coverage options. Essential cover offers basic cover and Premier cover provides more extensive cover. LV Insurance does not offer separate policies for baggage and winter sports cover. If you want to be covered for one or both of these things, you can choose to add them on to either the single trip or annual multi-trip base policies.

Discover how LV travel insurance works, whether it is good value for money and what current customers think in our LV Travel Insurance guide.

LV Insurance login and policy management

While LV Insurance does offer customers an online account, it is not quite the same as the online system offered by other insurance providers. Firstly, an online account is currently only available to customers who have a car, home or landlord insurance policy. Additionally, the only thing these customers can do on their online account is view and download policy documents.

LV has stated that it’s working to improve its online account features and extend the system to all customers, but for now, if customers want to actually do anything with their policy - such as change some details or cancel the policy altogether - they need to ring LV’s customer service team.

If you need to contact LV to change anything to do with your insurance policy, head to our LV contact page to find the best way to get in touch.

How to log in to your LV account

If you have a car, home or landlord insurance policy with LV and want to access your policy documents online, you can log in to your LV Insurance account. To do this you need to access the LV My Account login page. The easiest way to get to it is by clicking the following link: LV Insurance login

To log in, type the email address associated with your policy where it says Email address, and type your password into the box where it reads Your password. Then press the blue box that says Log In and you will be taken to your personal account.

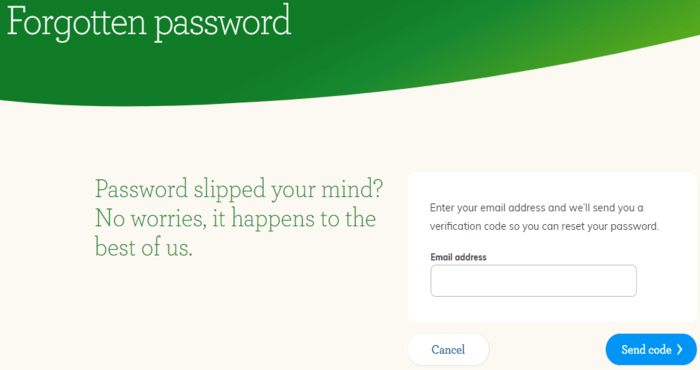

I’ve forgotten my password

Setting up a new password for your LV online account is really easy. If you’ve forgotten your password, click the I’ve forgotten my password link that is underneath the password box on the account login page.

This will take you to a new page where you will be asked to enter the email address that is associated with your account. Type this email in and click the Send Code button. LV Insurance will then send you an email with a verification code which you can use to set up a new password.

I don’t have an LV account: how can I get one?

Customers who took out a car, home or landlord insurance policy after 30/04/2019 will automatically have an online account so do not need to register for one.

If you took out a car, home or landlord policy with LV before this date, you will be given the option to register for an account if you renew your policy online. Until this time, you are not able to set up an account.

If you have a different policy with LV (not car, home or landlord), you currently cannot have an online account. LV Insurance seems to realise this is a bit of a pain for its customers and is working on creating an online account system for all. There is no timescale on this development but LV has said it will contact all customers when the universal account system is ready (let’s hope it’s sooner rather than later).

Dealing with LV insurance renewals

3 weeks before your policy is due to run out, LV Insurance will send you a Renewal Pack that will contain:

- Details of the cover included in your policy.

- A renewal quote.

- Details about any extras you have chosen to add on to your policy.

If any of these details are wrong, you need to contact LV Insurance and correct the details. When the details are sorted, LV will send you a new renewal quote.

If you have a car or home insurance policy with LV and do not want to make any changes to your policy after receiving the renewal pack, you can renew your policy online. Simply head to the LV Insurance renewal form and fill in all the required details. You will need to have your current policy number and the date it runs out to hand. Don’t forget: this is your chance to set up an online account if you don’t have one.

If you have a different type of insurance policy with LV, such as travel or pet insurance, you will need to ring LV in order to renew your policy. You can find all of the relevant phone numbers on our LV Contact page.

What happens if I’ve chosen automatic renewal?

As the name suggests, if you chose automatic renewal when you took out your policy, it will renew automatically. You literally do not need to do anything: the day your old policy runs out, the money for the new one will be taken from your account using the credit or debit card details you used to pay for the previous one. If you arranged to pay monthly for your last policy, this will continue to apply.

If you’ve changed your mind and do not want your policy to renew automatically, you will need to contact the relevant customer service team at LV to let them know. You need to do this before your set renewal date.

Automatic renewal!A lot of insurance companies will sign you up for automatic renewal when you take out a policy. If you do not want your policy to automatically renew, make sure you cancel this straight away; it’s easy to forget and get tied into the policy for another year.

How do I get a quote from LV?

Getting a quote for any insurance policy with LV is pretty easy and can all be done online. On the LV Insurance website, simple choose the type of insurance you want and click the Start a […] quote button. For example, if you want to get a quote for home insurance, click the Start a home quote button. These buttons can all be found on the website’s main page.

To get an accurate quote you will need to provide your personal details and information relevant to the insurance, for example, details about your car if you want a car insurance quote. If you are happy with the quote you receive you can purchase the policy straight away, but remember it’s always a good idea to shop around and compare quotes from a few different providers before deciding on which one to go with.

Quick review of LV insurance

What do current and previous customers think of LV Insurance? Well LV ranks very well on a number of customer review sites. On review site Reevo, for example, 99% of all respondents would buy insurance from LV again, and 92% said any queries or issues they’ve had have been handled effectively. In general, they report that the customer service is prompt and friendly.

Rang them and within a very short time my questions had been answered and insurance put in place. Overall good experience. Ann

Reviews left on TrustPilot tell a very similar story. Out of all the UK insurance providers we have reviewed (Aviva, Covea and AXA), LV Insurance rates the best on TrustPilot; and it does so by a significant amount! Whereas AXA, Aviva and Covea received 1.9/10, 1.5/10 and 5.2/10 respectively, TrustPilot gives LV Insurance 9.1/10. Out of the 5,166 reviews left on the site, 74% rate LV as excellent, claiming quieres and claims were handled quickly by professional and friendly customer service agents.

The claims handling team were top notch, friendly and understanding, keeping me up to date and answering all my questions. The claim was settled and put a new car onto the policy and that was a breeze too! Robert

However, a large amount of negative reviews mention the price of the policies. This is a particularly common theme on the site reviews.io. Many customers here complain about prices increasing significantly when they go to renew their existing policy.

When LV sent my renewal It had increased from £147 to £242 an increase of 65% even though I had not made a claim with any insurance company home/ contents policy for over 50 years. LV customer

Customers on Reevoo also note this trend, but mention it more as a word of warning instead of a negative aspect of the company.

Good price when changing but does tend to go up in the 2nd year and beyond. Great if keep switching and good service when used in past hence my return to them this year. Michelle

Overall, LV Insurance seems like a great choice when it comes to customer experience, coverage and price during the first year, but quite drastic price increases after this initial year means it is not necessarily the best company to renew with year after year, especially if price is very important to you.

For reviews that are more focused on value for money and coverage, head to one of our individual LV Insurance guides: LV Home Insurance, LV Car Insurance (coming soon), LV Travel Insurance.

Customer Service Awards

Highlighting the quality of LV Insurance’s customer service, the company has won a few awards in this area recently:

- 2017 - Most Trusted Insurance Provider (Moneywise Customer Service Awards)

- 2018 - Claims satisfaction for both car and household insurance (Consumer Intelligence Awards)

In 2019 it was also ranked in the top 10 for best customer service by the Institute of Customer Service.

Complaints handling

A good way to review a provider’s customer satisfaction is to look at how many complaints it receives and how good the company is at dealing with them. In the last 6 months of 2018, LV Insurance received 1.82 complaints for every 1,000 policies in force, which is amongst the lowest ratios when compared to other UK providers.

However, while LV might receive less complaints than others, it is less efficient at handling them. It managed to close 10,157 complaints in this 6 month time frame, 29% of which were closed within 3 days and 56% were resolved within 8 weeks. Both of these percentages are on the slow side compared to other providers. AXA, for example, managed to close around 40% of the complaints it received within 3 days.

The main reason for customer complaints received by LV Insurance was general administration and customer service.

Jobs at LV Insurance UK

LV employs 5,500 people in its 14 offices across the UK. Working for LV Insurance comes with a great variety of career options, such as communications, finance, human resources, legal, marketing, technology, risk and compliance, customer service, and, of course, insurance underwriting. Employees benefit from many perks and LV also has a number of Academies that workers can attend to learn new things and develop existing skills.

Are you interested in working for LV insurance? Keep an eye on the LV Careers page to see what opportunities arise. You can also register for LV job alerts to ensure that perfect job doesn't pass you by.

Selectra’s verdict

LV has been around for more than 175 years and has many loyal customers. It’s a well known name in the UK insurance market that customers trust, and they are not wrong to do so. LV offers good insurance policies and provides customers with a very good customer service experience. You should never undervalue the importance of good customer service: The last thing you want is an insurer you can never get hold of and takes a long time to process claims.

Considering LV has so many returning customers, it is both a surprise and a shame that it does not offer better incentives and rewards for those who do return year after year. The tendency for a renewal quote to increase quite significantly seems to punish returning customers rather than reward them. Moreover, LV Insurance is way behind other providers when it comes to policy management. We really hope it improves its online account system soon as it will be a great benefit for all of its customers.

|

|

|

|---|---|

| Receives good customer reviews online and provides prompt and friendly customer service. | Is not the cheapest option. Price tends to rise significantly when policy is renewed so offers no incentive to returning customers. |

| Offers a wide range of policies. If opting for basic policies, price is competitive and coverage is adequate. | Online account system is basically non-existent. It’s only available for certain customers and has very limited features |

Data and information correct as of July 2019.

All material on this page and the selectra.co.uk website is for information purposes only and does not constitute any form of financial advice. Selectra.co.uk is not responsible for any consequences that might arise from your use of the information provided.

Other providers are available and the best deal for you will depend on your individual circumstances. Please do your own research and seek professional advice if necessary (moneyadviceservice.org.uk offers free, independent advice on all financial issues).

LV Insurance 2019

How do I contact LV Insurance?

LV Home Insurance - contact, review, complaints, login, quote

LV Car Insurance: Login, Numbers & Reviews

LV Travel Insurance: What do You Need to Know?