About AXA

AXA is a French multinational insurance firm that works in the life insurance, health insurance, property insurance, casualty insurance and investment management sectors. The AXA group is made up of many different independently run subsidiaries in a total of 61 countries. Let’s take a look at AXA in more detail, paying particular attention to its insurance arm in the UK.

History of AXA Group

AXA developed from a small mutual insurer based in Normandy called Ancienne Mutuelle de Rouen. In 1975, Claude Bébéar became CEO of Ancienne Mutuelle with the aim of making it an international firm. His hard work paid off, the AXA brand came to life in 1985 and started to thrive.

In 1989 it took its first steps to becoming truly international, opening businesses in the UK, the Netherlands and Germany. In 1996 the group merged with the French insurance firm UAP to become France’s top insurer. By 2009 it was ranked the world’s number one insurance brand in Interbrand’s (a brand consultancy firm) rankings.

What does AXA stand for?

The name AXA is not an acronym, so does not actually stand for anything. When rebranding the company, its founder Claude Bébéar wanted to create a name that was easy to pronounce no matter the language. Thus AXA came to life; an international name for an international company.

Present day

As of 2019, AXA has 105 million customers worldwide and operates in 61 different countries across Europe, the Americas, Asia and Africa. In 2018 Interbrand named AXA the number one insurance brand worldwide for the tenth consecutive year.

The AXA group headquarters are in Paris, France, and its current CEO is Thomas Buberl.

Timeline of AXA

- 1985 - Ancienne Mutuelle de Rouen is rebranded as AXA.

- 1989 - The company is listed on the stock market for the first time.

- 1989 - AXA opens businesses in the UK, the Netherlands and Germany.

- 1991 - The insurer continues to expand and acquires a majority interest in US life insurance firm Equitable.

- 1995 - It expands to Asia, acquiring Australian group National Munk and its Hong Kong based subsidiary.

- 1996 - AXA merges with UAP to become the biggest insurance firm in France.

- 2006 - The company acquires Swiss firm Winterthur.

- 2009 - Interbrand ranks AXA as the global number one insurance brand.

- 2015 - AXA is the official partner of the COP21 climate change event.

- 2016 - AXA stops investing in all tobacco shares.

- 2018 - The international insurance company acquires XI group to become the world’s number one commercial P&C insurer.

Finances

In 2018 AXA’s annual revenue was €102.9 billion. This was a 4% increase from 2017 and made AXA the second largest insurance company by revenue in the world! Divided by geography, AXA makes the greatest percentage of its overall revenue (36%) in Europe (excluding France). This is closely followed by France, where the company makes 24% of its total revenue. For up to date facts and figures on AXA’s finances, have a look at the AXA financial reports.

AXA share price

Individual shareholders collectively constitute an important partner of AXA. As of December 2018, the general public holds 78.69% of the company’s capital, which totals 1,907,286,947 shares.

Shareholders are invited to take part in regular shareholder meetings and exchanges. They also enjoy the many benefits of being a Shareholder’s Circle member, such as trade fairs, private guided museum tours and special rates on fine wine from AXA vineyards in France and Europe.

To track AXA's share prices over the last year, head to AXA's share performance review. On this page, the company also has a performance calculator that can show you how your shares have performed over a period of time.

AXA UK

AXA first came to the UK in 1989 and remains one of the country’s best known insurance companies. AXA UK is currently made up of a number of different businesses and companies:

- AXA UK plc

- AXA Insurance UK plc (which includes the online insurer Swiftcover)

- AXA PPP healthcare limited

- Health-on-Line Company (UK) ltd (which trades under the names Health-on-Line, Securehealth and InsureMe-on-line)

- Health and Protection Solutions Limited (which trades as The Health Insurance Group)

- AXA ICAS Ltd (business name ActivePlus)

- The Permanent HEalth Company Ltd

- PPP Taking Care Ltd

Does AXA Sun Life still exist?

AXA Sun Life was a life insurance business based in Bristol. The company actually existed before AXA took over and still exists today but is no longer part of the AXA brand.

In 2000, AXA acquired all the company’s shares and rebranded it to AXA Sun Life. However, in 2016 it sold the business to UK insurer Phoenix as part of a £375 million deal. Today the business simply trades under the name SunLife and has no connection to AXA.

AXA insurance in the UK

AXA provides home insurance, car insurance, travel insurance, health insurance, life insurance and business insurance in the UK. Let’s take a look at its home, car and travel insurance policies individually.

Home insurance

AXA UK has three main home insurance policies: HomeSmart, HomeSafe and HomeSure. The three policies offer the same basic coverage but they differ on maximum claim limits and the extra cover they include. HomeSmart, for example, is the barebones policy with the lowest claims limits, whereas HomeSafe offers the most premium level of cover with unlimited claim limits.

You can tailor any of these policies to fit your needs by adding extra cover, which allows you to only pay for the coverage you require. Visit our AXA Home Insurance guide to find out more.

As well as standard home insurance, AXA also offers tenants insurance and landlords insurance. Read Selectra’s individual guides to home insurance, buildings insurance, contents insurance, tenants insurance and landlord insurance for more information on the different types of home insurance out there.

Car insurance

AXA UK offers the two principal types of car insurance: comprehensive car insurance and third party, fire and theft car insurance. Its car insurance plans start from £214 a year and can include a courtesy car, wrong fuel cover, and breakdown cover so that you’re never left stranded at the roadside.

The Uninsured Driver Promise means AXA will still cover you if you are involved in an accident with an uninsured driver, and help is available 24/7 every day of the year. You can also take out multicar insurance and commercial van, personal van and courier van insurance with AXA UK. Read Selectra’s complete guide to AXA Car Insurance (coming soon) to find out more.

Travel insurance

For travel insurance, AXA offers a few different types of insurance plans depending on what your holiday involves and your personal circumstances. These plans are:

- Single trip travel insurance: covers you for up to 120 consecutive days abroad during one holiday.

- Annual multi-trip travel insurance: covers you for multiple holidays of up to 45 days per trip throughout the year. The number of individual trips is unlimited.

- Medical travel insurance: designed to cover people with pre-existing medical conditions while they travel (available as single or multi-trip insurance).

- Adventure travel insurance: covers you for diverse sports and leisure activities that aren't covered in standard travel insurance, such as bungee jumping and jet skiing (available as single or multi-trip insurance).

- Winter sports and ski insurance: includes emergency medical cover, as well as cover for your ski equipment and lift passes (available as single or multi-trip insurance).

Within each of these plans there are three different levels of cover: Bronze, Silver and Gold. Bronze is the most basic and Gold offers the most comprehensive cover. To get more details about the different types of travel insurance and levels of cover offered by AXA, check out our AXA Travel Insurance guide.

AXA login: manage your policy online

All AXA customers can set up an online account where you can manage your policies. On your MyAXA account you can view your policy to check exactly what you are covered for, make changes to your policy anytime you want, find information on how to make a claim, and see and edit your payment details. Unfortunately you cannot manage renewals or cancel your policy via your online account.

Beware of auto-renewal!When you take out an insurance policy most companies will put you on auto-renewal, which means that your policy will automatically renew after one year. Once you have passed the 14 day cancellation period you will be charged a fee to cancel your policy, so it is wise to cancel automatic renewals. To cancel automatic renewals with AXA, you need to contact AXA directly.

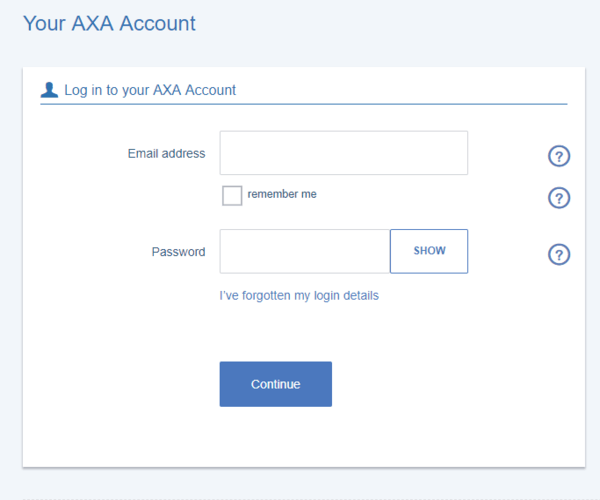

How do I log in to MyAXA account?

You can log in to your account through the AXA login homepage. On this page, there is a box to enter your email address and a box to enter your password.

In the box next to Email address type in the email address you used to set up your AXA account. In the box next to Password enter the password you used to set up your account. Next to the box there is a button called SHOW. If you press this you will be able to see your password (rather than just the blue dots) so you can make sure you have spelt it correctly. When you have entered both your email address and password, press the blue box that says Continue and you will be logged in. That’s all you need to do!

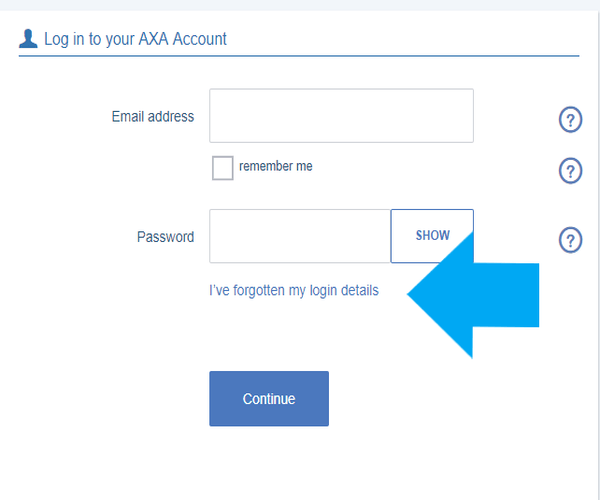

What if I have forgotten my login details?

If you can’t remember your password, it’s not the end of the world. Simply click the link that says I’ve forgotten my login details, which is underneath the password box on the login page.

You will be taken to a new page where you need to enter the email address you used to set up your account and your date of birth.

Press Continue and follow all the instructions to reset your password. When you have reset your password you will be able to log in to your AXA account using this new password.

If you have forgotten your email address things are slightly more complicated. First things first, enter all the email addresses you have one and by one and try logging in with each of them (make sure your password is right!). Start with the one you most likely used to set up your account and work your way through to the least likely. If you don’t have many email addresses this should be really easy and you will probably find that one of them is the right one.

If you have tried all the email address you can think of (and you are sure your password is correct) but you still can’t log in, you will need to contact AXA directly.

Underneath the box where you enter your email address on the AXA login page, there is a tick box and the phrase remember me. If you check this box your email address will be saved on the page so you don’t need to remember it. Remember: do not use this feature on public computers or any devices you share with lots of people (such as tablets).

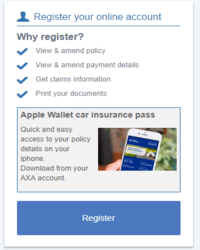

I don’t have an account, how do I get one?

Anyone who has an insurance policy with AXA can have an online account. To set one up, head to the AXA login page. On the right hand side of the page there is a box with the heading Register your online account. At the bottom of this box there is a blue button that reads Register.

Click this box and follow all the instructions. To complete the registration process you will need your email address, policy number and date of birth, and will be asked to set up a password. AXA will send a 6-digit verification code to your email address. Enter this verification when instructed and the registration process is complete. You will now have your own AXA account set up and ready to use.

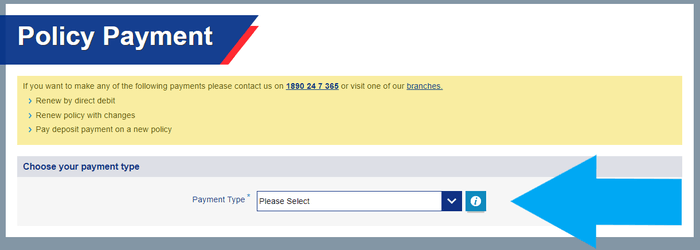

Can I pay my AXA insurance online?

Yes, you can make your AXA payments online but you cannot pay through your MyAXA online account. If you want to pay for your policy in full, pay for a recent change to your policy, pay in full for your policy renewal or pay a missed monthly installment, go to the AXA payment form. Select the relevant option from the payment type drop down box and follow the instructions to make your payment.

AXA will let you pay your policy in monthly installments online too. This lets you spread your payments out over 10 months. You will be asked to pay an initial 15% deposit then the rest of your payments will be spread over nine equal instalments.

When you take out your policy you can set up your bank details so that the money will be taken from your bank account on the first working day of every month. However, when you pay by direct debit in this way you will be charged 6.715% interest on each payment and will also be subject to APR (yearly interest rate) at 17.04%. As a result, paying your full policy in one payment can work out cheaper.

How do I contact AXA UK?

For each AXA department - car insurance, home insurance, travel insurance and so on - the contact details are different. You can find all of the details for the individual departments in our AXA contact page.

Remember: if you are a customer you can find a lot of answers in your MyAXA online account so it’s always a good idea to start there first.

Jobs at AXA

AXA employs 171,000 people worldwide and offers many benefits and perks through its employee benefits system known as AXA Max. If you are interested in working for AXA, check out the AXA UK job website to see current opportunities and to find out what it is like to work for the insurer. In the UK, AXA has offices in:

- Glasgow

- Newcastle

- Teeside

- Leeds

- Manchester

- Bolton

- Leicester

- Birmingham

- Ipswich

- Haverhill

- Gloucester

- Bristol

- Cardiff

- Reading

- London

- Redhill

- Weybridge

- Cobham

- Royal Tunbridge Wells

- Eastbourne

- Ashburton

What kind of careers are available?

As with many large international businesses, you can pursue a range of different careers at AXA. Working for the insurer doesn’t necessarily mean that you will be directly working in insurance! Careers in healthcare, customer services, digital and data, insurance and financial services, professional services, sales and account management, and support services are all available.

Is there an AXA graduate scheme?

The AXA group does have a graduate scheme but it is not offered in the UK. Instead, AXA UK welcomes graduates straight into entry level jobs in all of the different career areas mentioned above. If you are interested, head to the Early Careers section on the AXA UK job website.

While there is no graduate scheme available in the UK, AXA UK does offer apprenticeships. These allow you to study and earn qualifications while gaining valuable on-the-job experience (and earning!) at the same time.

AXA promo codes and discounts

Various websites offer deals and discounts on AXA insurance policies. Some call these AXA promo codes and others call them AXA voucher codes, but both are essentially the same thing. They can be a great way to save a bit of money on an AXA Policy, such as a 15% discount on AXA multicar insurance and reduced rates on AXA annual multi-trip travel insurance.

You can find these AXA promo codes on websites such as vouchercloud. They always have an expiry date and offers frequently change so keep an eye on what is available.

AXA customer service reviews

Considering AXA has 107 million customers, its surprising to find that the company does not feature heavily on many review sites. The only review site on which customers have left a substantial number of reviews is Feefo. AXA have actually teamed up with Feefo and so encourage customers to leave reviews there - this explains why this comparison site has so many more reviews than others.

From 47,600 customer reviews, 35,210 gave AXA five stars, and overall Feefo awards AXA a 4.6/5 rating. Customers on Feefo generally praise AXA’s customer service, claiming it is efficient and helpful.

Agent was very courteous and clear took me through all the steps and made everything very easy. Lynne

Where one can find AXA customer reviews on other sites, they paint quite a different story. On TrustPilot, for example, 86% of customers rate AXA as bad and overall it has a very low score of just 1.9/10. In fairness, this low score is only based on 681 reviews, but both the score and comments show that a number of customers are tired of AXA and its customer service, stating call agents are unhelpful and very slow to pick up the phone.

Absolutely atrocious customer service, takes at least 45 mins to answer your phones, no communication whatsoever and when you eventually get through they basically tell you nothing. AXA customer

From this information, it’s quite hard to gauge an overall picture of AXA customer service. While Feefo’s 47,600 reviews to TrustPilots’ 681 suggests Feefo gives a much better picture of how customers feel, Feefo is where AXA encourages customers to post reviews, suggesting these reviews are more heavily weighted towards solely good experiences (if someone has phoned to complain about a bad experience, the call agent is not going to encourage them to leave a review!).

Here at Selectra we think these customer reviews need to be taken with a pinch of salt: Feefo’s are probably a bit biased towards the good experiences, and sites like TrustPilot lean more towards the bad. The reviews are good to read and take into account, but other factors - like price and what cover the policies actually contain - are equally, if not more, important when trying to choose an insurance provider.

To see how AXA stacks up in these other key areas, head to the relevant AXA insurance guide: AXA Home Insurance, AXA Car Insurance (coming soon), AXA Travel Insurance.

AXA complaint handling

Companies are legally required to publish their complaints data. According to AXA Insurance UK’s own figures, in the last six months of 2018 it received 1.82 complaints for every one thousand policies in force, which is a pretty good ratio and towards the lower end of the amount received by insurance companies in general.

In this time frame, AXA resolved a total of 12,953 complaints. It closed 40.3% within 3 days, which is more than a lot of other providers we have reviewed. However, it only closed 41.90% within 8 weeks, whereas a lot of other companies managed to close nearly 20% more in the same length of time.

Of all the complaints AXA received in these 6 months, it recognised 68% to be valid, meaning it disregarded 32% of all complaints. This seems like quite a big percentage of complaints to dismiss as not worthy of resolving, but it is actually less than the figure of many of the other main insurers such as Aviva, LV and Allianz.

The main topics of complaints received by AXA were delays and timescales, suggesting customers are dissatisfied with the length of time AXA takes to deal with claims and issues.

Selectra’s verdict

AXA UK offers a range of insurance policies with different coverage levels, which gives customers plenty of choice. The extensive range of add-ons also means that customers can create a policy to suit them and just pay for the exact coverage they need. The company receives quite a low number of complaints suggesting a lot of customers are happy with their policies and customer service experience.

However, the number of very bad reviews on multiple review sites cannot be completely ignored. Plus, AXA is less efficient than other companies at dealing with complaints and sorting out claims. If fast service when something goes wrong is what you want, AXA UK falls a bit short.

|

|

|

|---|---|

| Lots of different coverage options tailored to suit individuals | Customers complain about delays in dealing with claims |

| Receives fewer complaints than many other companies | Is less effective than other providers at resolving complaints |

Data and information correct as of July 2019.

All material on this page and the selectra.co.uk website is for information purposes only and does not constitute any form of financial advice. Selectra.co.uk is not responsible for any consequences that might arise from your use of the information provided.

Other providers are available and the best deal for you will depend on your individual circumstances. Please do your own research and seek professional advice if necessary (moneyadviceservice.org.uk offers free, independent advice on all financial issues).

AXA UK

AXA Travel Insurance: Reviews, Promo Code & Policy Details

Axa Home Insurance - login, review, contact, claims and quote

All AXA Contact Details: Car, Home, Travel & More